owe state taxes illinois

Ad Owe Over 10K in Back Taxes. Ad BBB Accredited A Rating.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

We may ask the Internal Revenue Service.

. If you dont already have a MyTax Illinois account click here. Getting a new job. The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability.

You can figure out what your take. If you live in a state that will tax forgiven student loans how much you pay depends on your state tax rate. You should file your tax return pay any amounts you owe.

Getting married divorced or dealing with a deceased spouse. If you have an amount on line 48500 you have a balance owing. You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state.

Your 2020 balance owing is due on or before. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Download Or Email IL-1040 More Fillable Forms Register and Subscribe Now.

Up to 25 cash back The Illinois tax is different from the federal estate tax. These Tax Relief Companies Can Help. Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers.

Ad BBB Accredited A Rating. That makes it relatively easy to predict the income tax you will have to. Some common circumstances that need to be reported on your state taxes are.

End Your IRS Tax Problems - Free Consult. In Indiana for example the state tax rate is 323. Illinois is saying I owe them state taxes but I didnt live or work there.

Check or money order follow the. Illinois currently withholds 24 percent in federal taxes and 495 percent in state income taxes though that may not be the total tax obligation depending on the winners. Complete Edit or Print Tax Forms Instantly.

End Your IRS Tax Problems - Free Consult. The Illinois income tax was lowered from 5 to. The tax of 102 should be correct if you are Single.

Ad Access Tax Forms. The default length for a tax payment plan in Illinois is. Yes the Illinois Department of Revenue allows those who cannot pay tax debts due to financial hardship to make installment payments.

The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and. The second column Base Taxes Paid shows what you owe on money that falls below your bracket. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Start wNo Money Down 100 Back Guarantee. Ad Honest Fast Help - A BBB Rated. For non-retirees calculating Illinois income tax is fairly easy as the state has a flat tax of 495 that applies to everyone regardless of income.

Vehicle use tax bills RUT series tax forms must be paid by check.

Pin On Real Estate Is My Passion

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Illinois Lost 56 Manufacturing Jobs Per Workday On Net In 2015 Illinois Job Manufacturing

My Refund Illinois State Comptroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

State Income Tax Rates Highest Lowest 2021 Changes

State Tax For Expats Filing Abroad

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

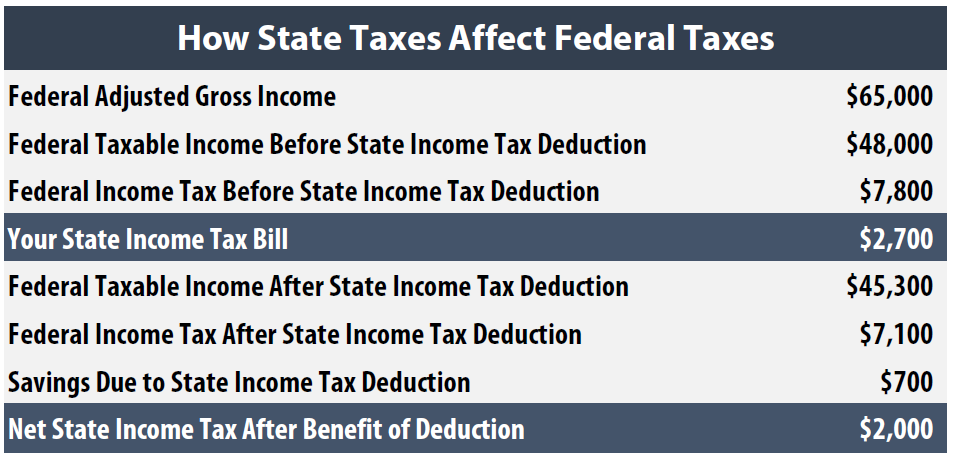

How State Tax Changes Affect Your Federal Taxes A Primer On The Federal Offset Itep

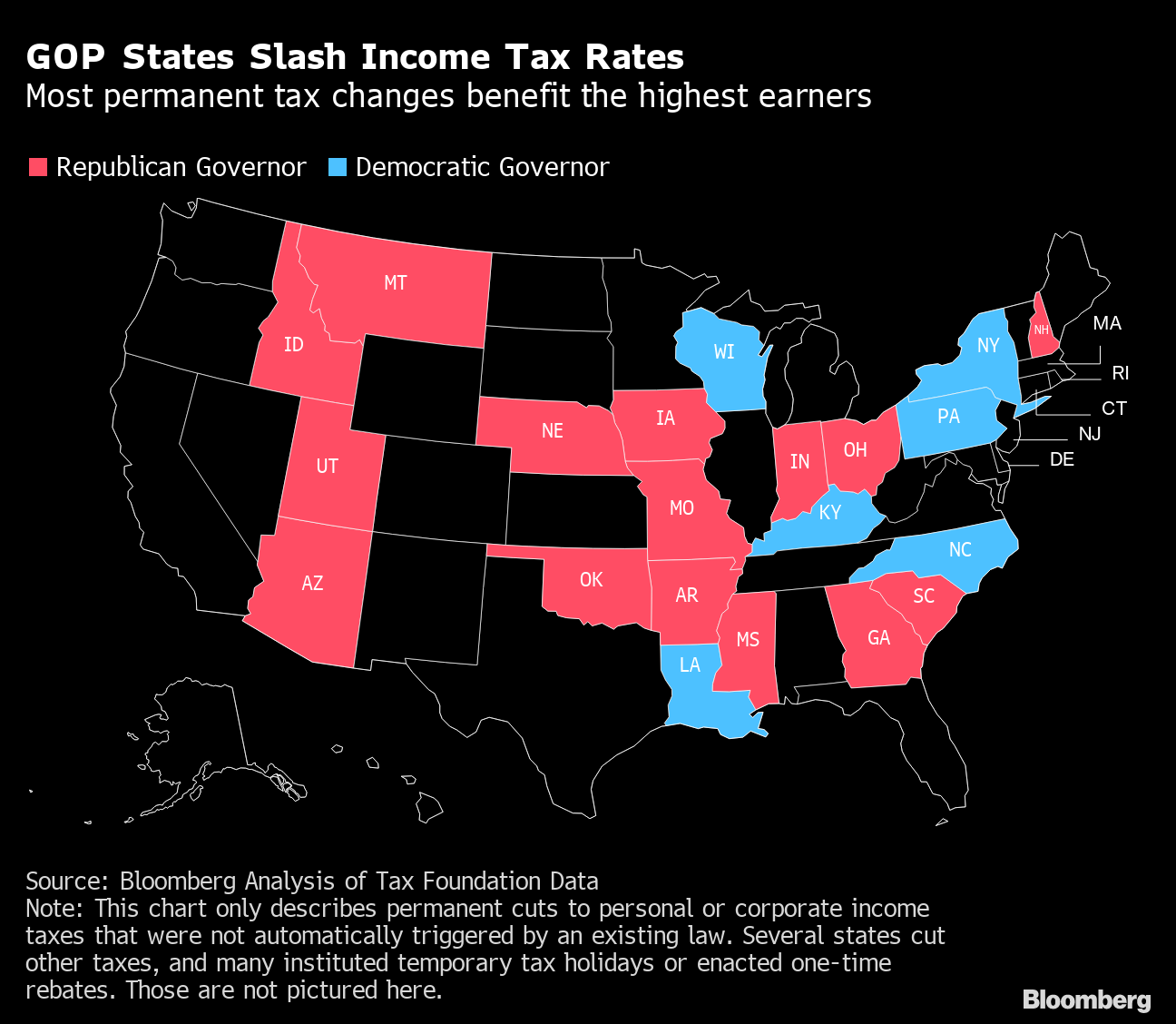

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

How Do State And Local Individual Income Taxes Work Tax Policy Center

Do I Have To File State Taxes H R Block

Illinois Income Tax Rate And Brackets 2019

A Brief History Of Income Taxes Teaching History History Facts Homeschool History